Nope. It is based on an inflation-adjusted counting of your highest 35 years of earnings.

Your filing cabinet?

-

Ken

- Posts: 16245

- Joined: Thu Jun 13, 2019 12:02 am

- Location: Washington State

- Affiliation: former MCUSA

Re: Your filing cabinet?

0 x

A fool can throw out more questions than a wise man can answer. -RZehr

Re: Your filing cabinet?

I see. I wonder where I got that.

0 x

-

Ken

- Posts: 16245

- Joined: Thu Jun 13, 2019 12:02 am

- Location: Washington State

- Affiliation: former MCUSA

Re: Your filing cabinet?

You might be thinking about traditional pensions. A lot of typical pensions for police, fire, teachers, etc. are based on a formula where they take your highest 3 years earnings (or highest 5 years earnings) and multiply that by the number of years that you worked in that profession and then a percentage multiplier.

For example in Texas where I used to teach they use the top 3 years average salary and a multiplier of 2.3%. So someone who's highest 3 year average was $50,000 and retires after 40 years of teaching would get a pension of

$50,000 x 2.3% x 40 years = $46,000 per year

That pension is not inflation-adjusted so $46,000 per year will be all that teacher gets for the rest of their life. And they won't get any social security since Texas doesn't pay into social security for teachers. Retired Texas teachers aren't getting rich. They get poorer the longer they live.

I cashed out my Texas teacher's pension and rolled it into an IRA since it wouldn't have accounted for much with only 9 years teaching there and inflation eroding the value of my highest 3 years every year until I retire. Pensions are much better for those who retire in the job, not those who work some place when they are younger then move on.

0 x

A fool can throw out more questions than a wise man can answer. -RZehr

-

MaxPC

- Posts: 9120

- Joined: Sat Oct 22, 2016 9:09 pm

- Location: Former full time RVers

- Affiliation: PlainRomanCatholic

- Contact:

Re: Your filing cabinet?

Seven years for tax forms. Once a year for health, life, and vehicle insurance.

0 x

Max (Plain Catholic)

Mt 24:35

Proverbs 18:2 A fool does not delight in understanding but only in revealing his own mind.

1 Corinthians 3:19 For the wisdom of this world is folly with God

Mt 24:35

Proverbs 18:2 A fool does not delight in understanding but only in revealing his own mind.

1 Corinthians 3:19 For the wisdom of this world is folly with God

- steve-in-kville

- Posts: 9633

- Joined: Wed Nov 02, 2016 5:36 pm

- Location: Pennsylvania

- Affiliation: Hippie Anabaptist

Re: Your filing cabinet?

This is all very helpful, thank you.

My payroll is all online now. I have direct deposit but used to get a paper stub in our mailboxes at work. They did away with that and now it is all online through an app. If I want to put in for vacation, I have to sign into the app. If I missed a timecard punch, or need one changed, gotta go through the app.

Makes me nervous at times....

My payroll is all online now. I have direct deposit but used to get a paper stub in our mailboxes at work. They did away with that and now it is all online through an app. If I want to put in for vacation, I have to sign into the app. If I missed a timecard punch, or need one changed, gotta go through the app.

Makes me nervous at times....

0 x

I self-identify as a conspiracy theorist. My pronouns are told/you/so.

Owner/admin at https://milepost81.com/

For parents, railfans, and much more!

Owner/admin at https://milepost81.com/

For parents, railfans, and much more!

- Josh

- Posts: 24202

- Joined: Wed Oct 19, 2016 6:23 pm

- Location: 1000' ASL

- Affiliation: The church of God

Re: Your filing cabinet?

They look at the average of your 10 highest-earning years across your entire life.

For a typical person these will be their most recent 10 years, due to inflation and the fact people often get raises.

(Or so it was explained to me when I went into the SSA office to fix some identification problems with my account.)

0 x

-

Ken

- Posts: 16245

- Joined: Thu Jun 13, 2019 12:02 am

- Location: Washington State

- Affiliation: former MCUSA

Re: Your filing cabinet?

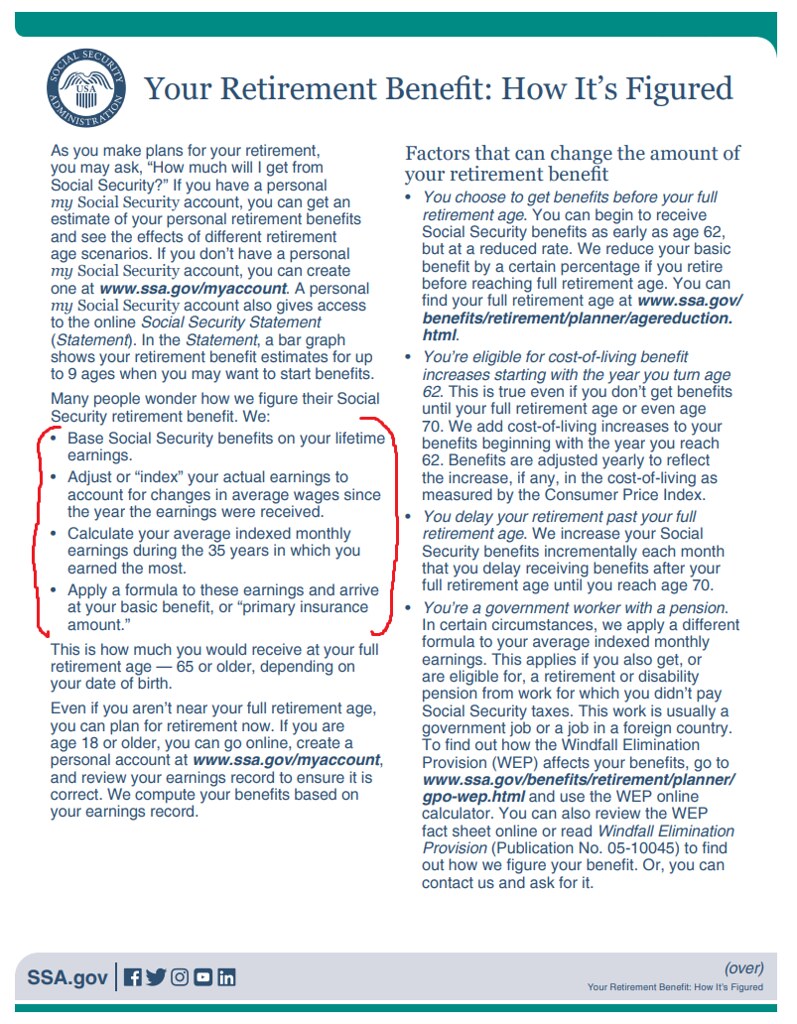

You were misinformed. This information is easy to find. Social Security has all kinds of explainers looking at different scenarios on their web site. Everyone who is going to be eligible for and receive Social Security in their retirement should understand how the program works so they can understand how the choices they make will affect their benefit. Here is Social Security's explainer pamphlet which summarizes it (but they have much more detailed information on their web site): https://www.ssa.gov/pubs/EN-05-10070.pdfJosh wrote: ↑Sun Nov 19, 2023 7:50 amThey look at the average of your 10 highest-earning years across your entire life.

For a typical person these will be their most recent 10 years, due to inflation and the fact people often get raises.

(Or so it was explained to me when I went into the SSA office to fix some identification problems with my account.)

So in effect, if you have less than 35 years of employment history when you retire, the formula gives you zeros for all those years up to 35 that you have no Social Security earnings.

There is also the issue of bend-points. https://www.ssa.gov/oact/cola/piaformula.html which are important for people close to retirement age to determine how much continuing to work versus retiring will affect their Social Security payment. Basically if your earnings history is low then you get more credit for future earnings than if it is high. The formula is progressive.

Do your own research if you are eligible for and counting on getting Social Security. There are also various free and paid calculators out there that will let you input your own earnings history and game out different retirement scenarios to figure out how to maximize your benefit. The program is complex.

0 x

A fool can throw out more questions than a wise man can answer. -RZehr

- Josh

- Posts: 24202

- Joined: Wed Oct 19, 2016 6:23 pm

- Location: 1000' ASL

- Affiliation: The church of God

Re: Your filing cabinet?

I’ll stick with what an SSA employee told me in person at my local SAA office, although it wouldn’t be the first time a federal employee was completely misguided.

0 x

-

Neto

- Posts: 4641

- Joined: Wed Oct 19, 2016 5:43 pm

- Location: Holmes County, Ohio

- Affiliation: Gospel Haven

Re: Your filing cabinet?

This (the bolded and underlined) is the crux of the matter in our case. By zeroing out the 18 years we were working in Brazil, they reduce my total years to less than 35. I would add that this 35 years of "paying in" is said by many to be a basic requirement. But I have heard all sorts of different explanations and formulas for how the IRS figures a person's SS benefits upon retirement. Not just any average person on the street, or even accountants. There's a radio program on the Moody Radio station here in our area, and they have a bit different understanding of it. Some say it's figured on the last ten years of employment. Others say that it is based on the 10 highest years out of the required 35 years. Etc.Ken wrote: ↑Sun Nov 19, 2023 12:31 pmYou were misinformed. This information is easy to find. Social Security has all kinds of explainers looking at different scenarios on their web site. Everyone who is going to be eligible for and receive Social Security in their retirement should understand how the program works so they can understand how the choices they make will affect their benefit. Here is Social Security's explainer pamphlet which summarizes it (but they have much more detailed information on their web site): https://www.ssa.gov/pubs/EN-05-10070.pdfJosh wrote: ↑Sun Nov 19, 2023 7:50 amThey look at the average of your 10 highest-earning years across your entire life.

For a typical person these will be their most recent 10 years, due to inflation and the fact people often get raises.

(Or so it was explained to me when I went into the SSA office to fix some identification problems with my account.)

So in effect, if you have less than 35 years of employment history when you retire, the formula gives you zeros for all those years up to 35 that you have no Social Security earnings.

There is also the issue of bend-points. https://www.ssa.gov/oact/cola/piaformula.html which are important for people close to retirement age to determine how much continuing to work versus retiring will affect their Social Security payment. Basically if your earnings history is low then you get more credit for future earnings than if it is high. The formula is progressive.

Do your own research if you are eligible for and counting on getting Social Security. There are also various free and paid calculators out there that will let you input your own earnings history and game out different retirement scenarios to figure out how to maximize your benefit. The program is complex.

But IF it is based on the top 10 years out of the required 35, then that makes some sense of what is meant by the additional paragraph that appears on my annual reports since they wiped the 18 years we were actually living in Brazil. The thing is, however, that they also wiped some years were we did not meet the requirements for the foreign earned income exemption, because we were in the States either all of a furlough year, or enough of it that we did not have sufficient time as legal foreign residents to qualify. (Foreign residency requires a permanent visa status in the country of residence. So the first two years we were in Brazil should not have been wiped in any case, because we were there under temporary 1 year visas for most of that period.) (Looking at the last report I received, they MAY actually be counting our furlough year of 1991, during which we spent the entire calendar year in the States.)

The paragraph in question reads as follows:

(The dollar figure always reflects my income from the previous year.)These personalized estimates are based on your earnings to date and assume you continue to earn $---- per year until you start your benefits.

Then they also include a separate page (one which I did not receive until they wiped all of our SS income for the years we lived in Brazil), titled "You Have Earnings Not Covered By Social Security".

So maybe this all makes a bit more sense now. (* See Note at end of this post.) They add the statement about the current estimate being based on the assumption that I continue to earn BLANK amount in the coming years BECAUSE THEY ARE NOT COUNTING ALL OF THOSE YEARS IN WHICH WE LIVED OUT OF THE COUNTRY, BUT PAID ALL SS TAXES ON ALL INCOME. That is, they think that I have not worked for 35 years yet. (They appear to be counting only around 25 or 26 years.) Looking back at the annual reports, I see that they dropped the Brazil years starting with the 2022 report. The 2021 report includes all of the annual data for the years we lived out of the country. As of that 2021 report, I had 48 years of paying SS taxes. The latest report, however, only shows 17 individual years as an SS tax payer, then groups the prior years.

1966 - 1980

1981 - 1990

1991 - 2000

2001 - 2005

(We resigned from WBT in 2005, after one year regular furlough, and one year of extended furlough, after our return to the States in 2003. They are not counting any of that income, either, even though we were living in the States, so did not qualify for the Foreign Earned Income Exclusion.)

(I started working in 1973, and they record no SS income during the 1975 year. That is not really true either, because I worked the entire 74-75 school year, at Grace Bible Institute. However, that may not count, as the school employed me using government grant funds. I do not have any of those pay stubs, so I don't know if I was paying SS tax on those earnings, or not. Then it is possible that I worked too little during the summer of 75, because I also volunteered at a Christian camp both that year (75), as well as during the previous summer (74), and I did not work at all during my Sophomore year (75-76), my first year at St. Paul Bible College.

* NOTE: However, IF the part about the top 10 years is true, then it shouldn't matter what I make in subsequent years, UNLESS those amounts are LOWER than the lowest of the top ten years at the time of the report. That is, as long as I make more in subsequent years than the lowest of my top ten, then the SS benefit amount should go up. I guess I was thinking in terms of being concerned that they were saying that the figure might go down, but not thinking that it might go up, because our annual income amounts for the years in missionary work were all lower than the last 10 years (as of the 2021 report). Anyway, as I said before, "Do not trust in man, or in the strength of a horse."

0 x

Congregation: Gospel Haven Mennonite Fellowship, Benton, Ohio (Holmes Co.) a split from Beachy-Amish Mennonite.

Personal heritage & general theological viewpoint: conservative Mennonite Brethren.

Personal heritage & general theological viewpoint: conservative Mennonite Brethren.

-

Neto

- Posts: 4641

- Joined: Wed Oct 19, 2016 5:43 pm

- Location: Holmes County, Ohio

- Affiliation: Gospel Haven

Re: Your filing cabinet?

One separate comment. It is the formula they use to calculate your benefits that they do not reveal. I don't think they want anyone to know what it is.

0 x

Congregation: Gospel Haven Mennonite Fellowship, Benton, Ohio (Holmes Co.) a split from Beachy-Amish Mennonite.

Personal heritage & general theological viewpoint: conservative Mennonite Brethren.

Personal heritage & general theological viewpoint: conservative Mennonite Brethren.