More specifically, in your personal business and finances, how long do you keep payment stubs, paycheck stubs, invoices, etc?

Every time this year, I go through the file cabinet and make sure all my insurance policies are updated, discard older invoices and such like. I've never been asked to produce hard copies of anything beyond six months old.

Thoughts on this?

Your filing cabinet?

- steve-in-kville

- Posts: 9632

- Joined: Wed Nov 02, 2016 5:36 pm

- Location: Pennsylvania

- Affiliation: Hippie Anabaptist

Your filing cabinet?

1 x

I self-identify as a conspiracy theorist. My pronouns are told/you/so.

Owner/admin at https://milepost81.com/

For parents, railfans, and much more!

Owner/admin at https://milepost81.com/

For parents, railfans, and much more!

Re: Your filing cabinet?

7-10 years. End of fiscal year, move the paper files into banker boxes. Start new fiscal year with empty files. Keep current year and last years papers in separate file cabinets. Move the two year old files into banker boxes. Then dispose of the oldest 7-10 year old banker boxes.

Digital files keep pretty much forever.

Digital files keep pretty much forever.

1 x

-

Ken

- Posts: 16244

- Joined: Thu Jun 13, 2019 12:02 am

- Location: Washington State

- Affiliation: former MCUSA

Re: Your filing cabinet?

No business records, only personal.

I have annual files in which I keep all tax-related receipts and statements to support tax deductions I have taken on my taxes. So mortgage interest statements, property tax statements, records of charitable donations, etc. These are not many so they fit easily into a separate hanging file for each year. They don't take much space so I have them going back about 30 years.

I also keep paper records of insurance policies, retirement and investment accounts, and other important financial documents organized in their own separate hanging files. Each year I put in the most recent annual statement and toss out the old ones. That is more in the event that my wife or someone else needs to sort out or finances in my absence.

Finally I keep paper records of other important documents like employment licenses, transcripts, etc. in separate hanging folders. And receipts for big ticket items that I might need to return or service at some point.

All of it fits into one drawer in my desk.

In a separate small fireproof safe I keep passports, birth certificates, marriage and adoption certificates, vaccination records, etc. in a "grab and go" accordion folder so that they are organized and ready to go in the event of an emergency. We had a bad scare back in Texas when a big range fire got to within about 1/4 mile of our house and burned up homes on the other side of the highway and we had to evacuate suddenly. Since then I keep all the difficult to replace documents in an accordion folder in a fireproof safe so that if we ever need to evacuate in a hurry again I can grab it and go without thinking.

I don't keep any monthly bank statements or other receipts on paper. Every year I download and save them all electronically so that if I ever want to locate the date at which I bought something or paid something I can do that.

I have annual files in which I keep all tax-related receipts and statements to support tax deductions I have taken on my taxes. So mortgage interest statements, property tax statements, records of charitable donations, etc. These are not many so they fit easily into a separate hanging file for each year. They don't take much space so I have them going back about 30 years.

I also keep paper records of insurance policies, retirement and investment accounts, and other important financial documents organized in their own separate hanging files. Each year I put in the most recent annual statement and toss out the old ones. That is more in the event that my wife or someone else needs to sort out or finances in my absence.

Finally I keep paper records of other important documents like employment licenses, transcripts, etc. in separate hanging folders. And receipts for big ticket items that I might need to return or service at some point.

All of it fits into one drawer in my desk.

In a separate small fireproof safe I keep passports, birth certificates, marriage and adoption certificates, vaccination records, etc. in a "grab and go" accordion folder so that they are organized and ready to go in the event of an emergency. We had a bad scare back in Texas when a big range fire got to within about 1/4 mile of our house and burned up homes on the other side of the highway and we had to evacuate suddenly. Since then I keep all the difficult to replace documents in an accordion folder in a fireproof safe so that if we ever need to evacuate in a hurry again I can grab it and go without thinking.

I don't keep any monthly bank statements or other receipts on paper. Every year I download and save them all electronically so that if I ever want to locate the date at which I bought something or paid something I can do that.

0 x

A fool can throw out more questions than a wise man can answer. -RZehr

Re: Your filing cabinet?

One time somebody threw away something that shouldn’t have been thrown away so now nothing gets thrown away ever. Everything (mostly receipts but also some notes and other documents) goes in to banker boxes which go into the far reaches of a storage room which is getting full. From there they go into the box of boxes (plywood) which is also getting full and which is kept out of sight, out of mind up in a loft where all the other out of sight, out of mind things go but where it is very much in the way of you ever do go up there. From there I don’t know; we may have to build a box of boxes of boxes. I think it all goes back about twenty years or so.

I will say that while no one has opened most of the boxes in recent memory, I have read through some of the old notes and found them interesting—some things never change and the good old days maybe actually weren’t so much. It was also handy to have them at hand when I was tracking down a bit of fraud, though that only involved digging into relatively recent boxes.

I believe the standard for retaining financial records, at least is seven years but I haven’t needed to verify that.

I will say that while no one has opened most of the boxes in recent memory, I have read through some of the old notes and found them interesting—some things never change and the good old days maybe actually weren’t so much. It was also handy to have them at hand when I was tracking down a bit of fraud, though that only involved digging into relatively recent boxes.

I believe the standard for retaining financial records, at least is seven years but I haven’t needed to verify that.

0 x

-

Ken

- Posts: 16244

- Joined: Thu Jun 13, 2019 12:02 am

- Location: Washington State

- Affiliation: former MCUSA

Re: Your filing cabinet?

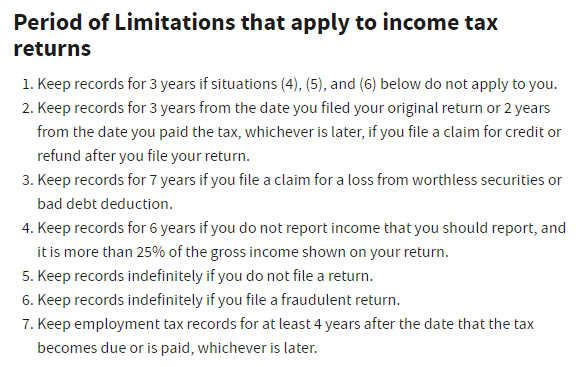

There are different standards depending on why you are retaining them.

The IRS says: https://www.irs.gov/businesses/small-bu ... ep-records

However financial records related to property that you own, investments that you own, insurance policies that you own, etc. should obviously be kept for as long as you own the property or investment or hold the policy. I mean you don't throw out your property deed or car title after 7 years. And that applies to for tax purposes as well because tax you owe upon sale of a piece of property or investment may be based on your original purchase price decades earlier.

So for financial records related to property, the IRS says:

0 x

A fool can throw out more questions than a wise man can answer. -RZehr

-

QuietlyListening

- Posts: 637

- Joined: Wed Jan 08, 2020 8:48 am

- Affiliation: Anabaptist @ baptist

Re: Your filing cabinet?

My husband worked for H&R Block many years ago. He does the taxes and has always kept records for at least 7 years. Periodically he will go up to the attic and clean out old years.

Mostly personal but since retiring he does some consulting work which is part of our personal taxes- not separate and continues to keep for the same amount of time.

Mostly personal but since retiring he does some consulting work which is part of our personal taxes- not separate and continues to keep for the same amount of time.

0 x

-

Neto

- Posts: 4641

- Joined: Wed Oct 19, 2016 5:43 pm

- Location: Holmes County, Ohio

- Affiliation: Gospel Haven

Re: Your filing cabinet?

The filing cabinet is full (6 drawer, legal size). Some of it is translation materials, most personal records, tax returns way back to "the beginning". While we lived in Brazil I kept the paper copies of all of the Scripture revisions, with the hand-written correction notes from each native speaker review. Several years after we moved back to the States, on a visit back there, we were told that we needed to empty out my office there. I was forced to throw all of the earlier revision copies away. A stack of paper probably 3 feet high. All down into a hole in the ground behind the office. A couple of old (no longer working) laptops went down there as well. Some things like tribal session reports are either still down there, in a barrel someplace, or someone has thrown them out. I have computer files that date back to 1990, when our computer guy in Brazil helped me convert all of the language files we had from our first computer, a Kaypro II, which ran WordStar, on the CPM operating system. (Converted into text files.) Over the years I sometimes made the mistake of "leaning too hard" into the then current technology. So some of the language description documents I have no longer show all of the information that was incorporated then, because there are internal links that no longer work in any program still available. Some things were before WYSIWYG ('what you see is what you get'), so encoded type styles don'r work anymore. For some things, paper is the best, or text files. I also have some conversion programs I set up that I no longer remember how to run. I did it so often while I was in the middle of it that it never occurred to me that I might forget how to do it, and I never made notes on how it was done. That's why now I make so many notes that I cannot find them anymore, in all of the thousands of data files. The curse of a literate society.

Regarding tax reports, I may need the copies of those when I retire, to prove to the IRS that we paid the full SS tax that entire time we were out of the country. The last couple of years I have received reports from them saying that we didn't pay into SS during those years, but we did. (We were self-employed for SS purposes, but employees for purposes of Federal taxes.)

Business records are in boxes here in my office at home. I don't keep purchase records (for computer components) beyond one year back, but I have the copies of all invoices I sent out, with notes written at the bottom of each, with the date payment was received, and their check number. Over 15 years worth. I also have the build sheets for every word processor or computer I've built. Several hard disks full of service notes, problem solutions, configuration notes, etc. Of course every purchase and every sale is also in the QuickBooks files, and I make regular backup copies. (Every day on which I make changes. Then periodically I go through that backup folder and delete all but those for bank and credit card reconciliation reports. Then for those more than 3 years old, I just keep the end or year backup copies, although I haven't cleared that out for some years now. The larger the hard disk drive, the more stuff I keep. Thus the mess of data files.)

I also have lots of downloaded books and articles, many about Dutch Mennonite history, old auto photos, repair procedures, and Service Guides - everything I find available. I have also scanned whole books and created PDF copies, so I can do word searches, etc. Others are about other hobby type interests. I guess I'm a pack-rat now. I subscribed to an auto collector magazine for several years, but cancelled it because I realized that I would never throw the old ones out. At one time (after completing college) all of my stuff would fit into several 'apple boxes'. Not anymore. (And there are some college text books that I now wish I hadn't let go.) My wife has kept a diary since her teen years, and she has all of them. (She's better about getting rid of old magazines than I am - she cuts out the articles she wants to keep, and tosses the rest, so she still subscribes to at least one monthly magazine.) My desk is a mess, because it's full of stuff that I don't know where to file, or because the file it belongs in is already too full for even one more sheet of paper. I do go through the piles from time to time, and toss the temporary time sensitive stuff. But for some reason, I have never been able to get as organized here as I was in Brazil.

Regarding tax reports, I may need the copies of those when I retire, to prove to the IRS that we paid the full SS tax that entire time we were out of the country. The last couple of years I have received reports from them saying that we didn't pay into SS during those years, but we did. (We were self-employed for SS purposes, but employees for purposes of Federal taxes.)

Business records are in boxes here in my office at home. I don't keep purchase records (for computer components) beyond one year back, but I have the copies of all invoices I sent out, with notes written at the bottom of each, with the date payment was received, and their check number. Over 15 years worth. I also have the build sheets for every word processor or computer I've built. Several hard disks full of service notes, problem solutions, configuration notes, etc. Of course every purchase and every sale is also in the QuickBooks files, and I make regular backup copies. (Every day on which I make changes. Then periodically I go through that backup folder and delete all but those for bank and credit card reconciliation reports. Then for those more than 3 years old, I just keep the end or year backup copies, although I haven't cleared that out for some years now. The larger the hard disk drive, the more stuff I keep. Thus the mess of data files.)

I also have lots of downloaded books and articles, many about Dutch Mennonite history, old auto photos, repair procedures, and Service Guides - everything I find available. I have also scanned whole books and created PDF copies, so I can do word searches, etc. Others are about other hobby type interests. I guess I'm a pack-rat now. I subscribed to an auto collector magazine for several years, but cancelled it because I realized that I would never throw the old ones out. At one time (after completing college) all of my stuff would fit into several 'apple boxes'. Not anymore. (And there are some college text books that I now wish I hadn't let go.) My wife has kept a diary since her teen years, and she has all of them. (She's better about getting rid of old magazines than I am - she cuts out the articles she wants to keep, and tosses the rest, so she still subscribes to at least one monthly magazine.) My desk is a mess, because it's full of stuff that I don't know where to file, or because the file it belongs in is already too full for even one more sheet of paper. I do go through the piles from time to time, and toss the temporary time sensitive stuff. But for some reason, I have never been able to get as organized here as I was in Brazil.

0 x

Congregation: Gospel Haven Mennonite Fellowship, Benton, Ohio (Holmes Co.) a split from Beachy-Amish Mennonite.

Personal heritage & general theological viewpoint: conservative Mennonite Brethren.

Personal heritage & general theological viewpoint: conservative Mennonite Brethren.

-

Ken

- Posts: 16244

- Joined: Thu Jun 13, 2019 12:02 am

- Location: Washington State

- Affiliation: former MCUSA

Re: Your filing cabinet?

You should get an online account with Social Security and then check to see what earnings records they actually have for you. It will all be there. If there are discrepancies, better to get it sorted out now than when you are filing for benefits.Neto wrote: ↑Sat Nov 18, 2023 8:50 pmRegarding tax reports, I may need the copies of those when I retire, to prove to the IRS that we paid the full SS tax that entire time we were out of the country. The last couple of years I have received reports from them saying that we didn't pay into SS during those years, but we did. (We were self-employed for SS purposes, but employees for purposes of Federal taxes.)

https://www.ssa.gov/myaccount/

0 x

A fool can throw out more questions than a wise man can answer. -RZehr

-

Neto

- Posts: 4641

- Joined: Wed Oct 19, 2016 5:43 pm

- Location: Holmes County, Ohio

- Affiliation: Gospel Haven

Re: Your filing cabinet?

They used to have it all in the annual reports they send out. Then more recently they dropped the earnings for all of those years. I consulted with a former (older) colleague who has already retired, and he said that he presented it at that time and it was straightened out. I also contacted WBT headquarters, to get their help with it, but they advised the same. What I wanted from them was a statement that we were, as I said, employees of WBT for purposes of Federal taxes, but self-employed for purposes of Social Security. We had been given a paragraph with exact wording, to be written in on every SS filing report, every year. But I don't know if the IRS keeps tax payer records that far back. So all I really have to show them is their own older annual reports (where those figures did appear). I am past 68, and will probably file for SS during the next year. If they do not accept it, then we will loose all we paid in for those 20 + years. ('Do not trust in man, or in the strength of a horse.')Ken wrote: ↑Sat Nov 18, 2023 9:06 pmYou should get an online account with Social Security and then check to see what earnings records they actually have for you. It will all be there. If there are discrepancies, better to get it sorted out now than when you are filing for benefits.Neto wrote: ↑Sat Nov 18, 2023 8:50 pmRegarding tax reports, I may need the copies of those when I retire, to prove to the IRS that we paid the full SS tax that entire time we were out of the country. The last couple of years I have received reports from them saying that we didn't pay into SS during those years, but we did. (We were self-employed for SS purposes, but employees for purposes of Federal taxes.)

https://www.ssa.gov/myaccount/

1 x

Congregation: Gospel Haven Mennonite Fellowship, Benton, Ohio (Holmes Co.) a split from Beachy-Amish Mennonite.

Personal heritage & general theological viewpoint: conservative Mennonite Brethren.

Personal heritage & general theological viewpoint: conservative Mennonite Brethren.

Re: Your filing cabinet?

I thought that for SS payout purposes, the SSA only looks at the last few years that were paid in? And not the whole lifetime contributions?

0 x