Private School Tuition and Tax Deductions

-

ken_sylvania

- Posts: 4092

- Joined: Tue Nov 01, 2016 12:46 pm

- Affiliation: CM

Re: Private School Tuition and Tax Deductions

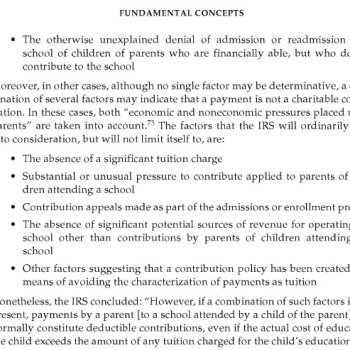

They're both screenshots from https://www.irs.gov/publications/p526#e ... 1000229696

0 x

-

ken_sylvania

- Posts: 4092

- Joined: Tue Nov 01, 2016 12:46 pm

- Affiliation: CM

Re: Private School Tuition and Tax Deductions

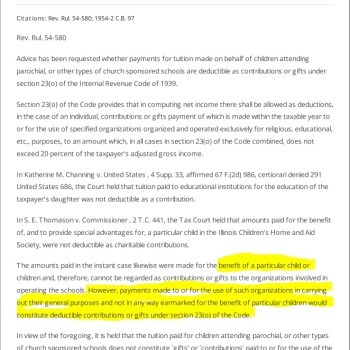

Would an actual IRS Ruling help?Ken wrote: ↑Wed Nov 22, 2023 5:49 pm By contrast, neither you nor RZehr have provided a single piece of evidence that that IRS has blessed this sort of arrangement or any guidance from the IRS or any other source explaining that this sort of arrangement is sound. Not even the written opinion of a tax attorney saying these arrangements are appropriate.

https://www.taxnotes.com/research/feder ... 4-580/d0dw

Again, the key is whether the donation is earmarked for a specific child, and whether the donation or lack thereof would make any difference in whether the child can attend school.

0 x

Re: Private School Tuition and Tax Deductions

Thanks.ken_sylvania wrote: ↑Wed Nov 22, 2023 7:49 pmThey're both screenshots from https://www.irs.gov/publications/p526#e ... 1000229696

BTW, one tax accountant’s answer is already back.

He says: “ Yes, my understanding is that these donations to a church are deductible, even if a church operates a grade school with the money.

There might be a few more qualifiers, like "no special designations", "no required monthly amount", or "church board decision needed", but I would have to do a little more research to get you a complete list of those. But yes, it can be deductible if you do it right, and it is very common in Anabaptist circles to treat it this way.”

0 x

-

ken_sylvania

- Posts: 4092

- Joined: Tue Nov 01, 2016 12:46 pm

- Affiliation: CM

-

ken_sylvania

- Posts: 4092

- Joined: Tue Nov 01, 2016 12:46 pm

- Affiliation: CM

Re: Private School Tuition and Tax Deductions

Here is the Internal Revenue Service Ruling regarding RZehr's situation:

From Internal Revenue Service Ruling 83-104

From Internal Revenue Service Ruling 83-104

Situation 6. Church X operates a school providing secular and religious education that is attended both by children of parents who are members of X and by children of nonmembers. X receives contributions from all of its members. These contributions are placed in X's general operating fund and are expended when needed to support all church activities. A substantial portion of the other activities is unrelated to the school. Most members of X do not have children in the school, and a major portion of X's expenses are attributable to its nonschool functions. The methods of soliciting contributions to X from church members with children in the school are the same as the methods of soliciting contributions from members without children in the school. X

has full control over the use of the contributions that it receives. Members who have children enrolled in the school are not required to pay tuition for their children, but tuition is charged for the children of nonmembers. Taxpayer, a member of X and whose child attends X's school, contributed $200x to X during the year for X's general purposes

Situation 6. The Service will ordinarily conclude that the taxpayer is allowed a charitable contribution deduction of $200x to Organization X. Because the facts indicate that X's school is supported by the church, that most contributors to the church are not parents of children enrolled in the school, and that contributions from parent members are solicited in the same manner as contributions from other members, the taxpayer's contributions

will be considered charitable contributions, and not payments of tuition, unless there is a showing that the contributions by members with children in X's school are significantly larger than those of other members. The absence of a tuition charge is not determinative in view of these facts.

0 x

- Josh

- Posts: 24202

- Joined: Wed Oct 19, 2016 6:23 pm

- Location: 1000' ASL

- Affiliation: The church of God

Re: Private School Tuition and Tax Deductions

That’s not how ACA insurance works. The out of pocket max is closer to $12,000. Co insurance (typically 20%, but often 50% for out of network) kicks in after meeting the deductibles. Since a routine procedure like an induced labour with an epidural followed by a C section often hits $100k in billing, frequently with a bill or two thrown in from some random specialist who is out of network, it’s very easy to hit the $12,000 mark from coinsurance.Today the average family deductible for an ACA silver plan is about $4,500 so anyone who has a median insurance plan should not have medical expenses that reach the 7.5% limit

Not to mention that the premiums themselves for a typical family are easily >$1,000 a month. So the family is spending $12k on insurance then another $12k on coinsurance and deductible. Now it’s a cool $24k.

Medical care is about 20% of GDP so it’s reasonable to presume people spend 20% of their income on medical care, which is quite a bit more than 7.5%.

0 x

- ohio jones

- Posts: 5305

- Joined: Wed Oct 19, 2016 11:23 pm

- Location: undisclosed

- Affiliation: Rosedale Network

Re: Private School Tuition and Tax Deductions

Well, not everyone has insurance. Maybe that's why their medical expenses are high enough to deduct. But even if they do, the cost of the insurance itself counts toward the 7.5%. I don't know what ACA plans cost these days; last time I checked I couldn't afford it. And then there are the costs not covered by insurance; dental, vision, expenses paid on behalf of someone else, nursing care, medications, etc. TurboTax tells me that for those who claimed this deduction, the national average was $23,201.Ken wrote: ↑Wed Nov 22, 2023 6:31 pmOK, let's look at a family of average income. The median household income in the US in 2023 was $74,580 so let's use that figure for someone of average income.ohio jones wrote: ↑Wed Nov 22, 2023 5:45 pmItemized deductions are not exclusively for the rich. I don't know where you come up with that. In fact the rich tend to be less generous and thus less likely for charitable contributions to enable them to itemize. Have you looked at the contributions made by the top people in government? Paltry. I give more than many of them, with much less income.Ken wrote: ↑Wed Nov 22, 2023 4:01 pm The only purpose and point of a donation receipt is so you have a piece of paper to prove you made the donation in the event are rich and trying to itemize and deduct it from your taxes. Ordinary Christians who are not rich have no need of such things. The standard deduction goes up to $29,200 next year which means your itemized deductions have to exceed that amount for there to be any point in keeping receipts in the first place.

Things other than contributions can also make itemization relevant. Take the case of a family with average income, but with high medical bills and a large mortgage. They might be able to itemize even without any contributions, but they certainly aren't rich, at least not after those payments.

First of all, medical expenses are only deductible if they exceed 7.5% of AGI and then only the amount that exceeds AGI. So for our family the 7.5% threshold would be $5,593.50. Today the average family deductible for an ACA silver plan is about $4,500 so anyone who has a median insurance plan should not have medical expenses that reach the 7.5% limit. That is actually very rare. But even if they had huge unreimbursed expenses of say $10,000 that only provides them with a deduction of $4,407. So we are still $24,700 short of exceeding the standard deduction.

Well sure, if they are far enough into the mortgage that half of the payment is principal, they may not be able to itemize. But if 2/3 of the payment is principal, very common in the first few years of a loan, that puts them close to the national average of $14,186 for those who take this deduction.The rule of thumb used for determining mortgage affordability is 28/36 meaning that you can afford a mortgage equal to 28% of your gross monthly income or 36% of your net monthly income. In the case of our median family, their gross monthly income would be $6,215 and they could afford a maximum monthly mortgage payment of $1,740. How much interest is contained within that maximum mortgage payment depends on where they are at in their mortgage, the interest rate, how much is PMI and escrow payment for homeowners insurance and so forth. But if we generously say that half their mortgage is deductible interest (and most aren't) and that they have the maximum mortgage they can afford that would produce deductible interest payments of about $10,000 per year. So now we are $14,700 short of exceeding their standard deduction.

The national average for those who itemize charitable contributions is $8,930.If this median family is tithing to their church at the standard 10% rate that would be another $7,458 and we are still $7,335 short of reaching the standard deduction. They would actually have to be tithing at a 20% rate to even reach the standard deduction and would need to be exceeding a 20% tithe rate to even consider bothering to itemize. I don't know how many families with school-age children are tithing at a rate higher than 20% but I suspect it isn't terribly common.

Receipts are not always necessary in order to deduct contributions. Contemporaneous recordkeeping will suffice in many cases.The only purpose and point of a donation receipt is so you have a piece of paper to prove you made the donation...

One category you left out completely is state and local taxes. Income tax, sales tax (including major purchases such as a vehicle), property tax, estimated tax payments, whatever. The normal limit for this category is $10,000; the national average is $14,186, so I'm not sure what's up with that.

You're assuming normal, average people with normal, boring, unfluctuating finances. Those are in the 90% who don't itemize, not the 10% who do. The deductions exist to provide relief for those with unusual circumstances. They can also benefit those who plan ahead to itemize every two or three years by "bunching up" their deductible expenses. That certainly includes people at or below the median income. It is not just for the rich.I would suggest that a family with children really needs a household income well into six figures in order to reasonably have enough deductible expenses to exceed the 2024 standard deduction of $29,200. Which in my book puts them squarely into the category of wealthy. Perhaps you have different standards. Can we generate a hypothetical family at the median household income who reaches it? Perhaps, but we have to really stretch to reach it and make edge assumptions about medical expenses, mortgage costs, and tithing to even get close. I would suggest that the vast majority of families at the median household income come nowhere close. So I stand by my contention that this is largely an accommodation for the wealthy. In 2022 approximately 90% of Americans took the standard deduction and only about 10% itemized their deductions. So I would suggest it is largely the terrain of the top 10% which I would define as the wealthy. The top 10% STARTS with a household income of $191,400 in this country. I would suggest that is wealthy.

0 x

I grew up around Indiana, You grew up around Galilee; And if I ever really do grow up, I wanna grow up to be just like You -- Rich Mullins

I am a Christian and my name is Pilgram; I'm on a journey, but I'm not alone -- NewSong, slightly edited

I am a Christian and my name is Pilgram; I'm on a journey, but I'm not alone -- NewSong, slightly edited

- Josh

- Posts: 24202

- Joined: Wed Oct 19, 2016 6:23 pm

- Location: 1000' ASL

- Affiliation: The church of God

Re: Private School Tuition and Tax Deductions

If someone has stocks, bonds etc that have a capital gain, contributing through a donor advised fund like Fidelity Charitable is an easy way to get a full deduction. First of all no capital gains are due at the time you donate to the fund, so it wipes out your gains (sort of like resetting your basis). Secondly, you can store your assets in the fund into you want to donate, and then you can deduct the full fair market value of the security up to 50% of your income.

0 x

-

ken_sylvania

- Posts: 4092

- Joined: Tue Nov 01, 2016 12:46 pm

- Affiliation: CM

Re: Private School Tuition and Tax Deductions

Curious if you ever got an answer from the second tax accountant?RZehr wrote: ↑Wed Nov 22, 2023 8:32 pmThanks.ken_sylvania wrote: ↑Wed Nov 22, 2023 7:49 pmThey're both screenshots from https://www.irs.gov/publications/p526#e ... 1000229696

BTW, one tax accountant’s answer is already back.

He says: “ Yes, my understanding is that these donations to a church are deductible, even if a church operates a grade school with the money.

There might be a few more qualifiers, like "no special designations", "no required monthly amount", or "church board decision needed", but I would have to do a little more research to get you a complete list of those. But yes, it can be deductible if you do it right, and it is very common in Anabaptist circles to treat it this way.”

0 x