That's an exageration...Josh wrote: ↑Wed Nov 22, 2023 4:16 pmExcept you've made a big deal that people shouldn't be deducting the value of meals, school tuition, and presumably the value of toilet paper in the loos, "rental fees" for use of the hymnals for an hour, and on and on. So which is it? Do they need to mark down the value of their charitable contribution by the $1.65 a cup of burnt coffee was worth, or not?Ken wrote: ↑Wed Nov 22, 2023 4:01 pmIt doesn't work like that. It is the opposite of that. No one needs receipts to do anything. Certainly not to participate in a church potluck. The only purpose and point of a donation receipt is so you have a piece of paper to prove you made the donation in the event are rich and trying to itemize and deduct it from your taxes. Ordinary Christians who are not rich have no need of such things. The standard deduction goes up to $29,200 next year which means your itemized deductions have to exceed that amount for there to be any point in keeping receipts in the first place.Josh wrote: ↑Wed Nov 22, 2023 3:49 pm Imagine a Mennonite church fundraiser which had you show some kind of donation receipt before you could get in line to get whatever food is being served. "Sorry, but you only donated $10.00, so you only get this cup of stale coffee in a styrofoam cup with creamers that date back to the Bush adminstration."

Private School Tuition and Tax Deductions

-

ken_sylvania

- Posts: 4092

- Joined: Tue Nov 01, 2016 12:46 pm

- Affiliation: CM

Re: Private School Tuition and Tax Deductions

0 x

- Josh

- Posts: 24202

- Joined: Wed Oct 19, 2016 6:23 pm

- Location: 1000' ASL

- Affiliation: The church of God

Re: Private School Tuition and Tax Deductions

It would be entirely kosher to have different rates of tuition for members and non-members. A preschool I am evaluating for my son is part of Christian churches and churches of Christ, and they have lower rates (albeit about 10% lower) for members. Their definition of "member" is "attended church at least half of the last 52 Sundays."ken_sylvania wrote: ↑Wed Nov 22, 2023 12:49 pmjoshuabgood wrote: ↑Wed Nov 22, 2023 12:22 pm I don't think legally, theoretically there would be a problem with charging tuition to those outside the church...fwiw.

0 x

-

Ken

- Posts: 16239

- Joined: Thu Jun 13, 2019 12:02 am

- Location: Washington State

- Affiliation: former MCUSA

Re: Private School Tuition and Tax Deductions

I haven't made a big deal about anything. I have simply pointed out the ACTUAL IRS guidance and regulations which state that if you make a charitable donation to an organization and receive something back of substantial value, you are supposed to subtract that amount from the total deduction you claim on your taxes. Whether whether you have a donation receipt and whether it is printed on the receipt or not. And there are detailed guidelines for how to do that. You are the one who keeps coming up with far-fetched or irrelevant examples.Josh wrote: ↑Wed Nov 22, 2023 4:16 pmExcept you've made a big deal that people shouldn't be deducting the value of meals, school tuition, and presumably the value of toilet paper in the loos, "rental fees" for use of the hymnals for an hour, and on and on. So which is it? Do they need to mark down the value of their charitable contribution by the $1.65 a cup of burnt coffee was worth, or not?Ken wrote: ↑Wed Nov 22, 2023 4:01 pmIt doesn't work like that. It is the opposite of that. No one needs receipts to do anything. Certainly not to participate in a church potluck. The only purpose and point of a donation receipt is so you have a piece of paper to prove you made the donation in the event are rich and trying to itemize and deduct it from your taxes. Ordinary Christians who are not rich have no need of such things. The standard deduction goes up to $29,200 next year which means your itemized deductions have to exceed that amount for there to be any point in keeping receipts in the first place.Josh wrote: ↑Wed Nov 22, 2023 3:49 pm Imagine a Mennonite church fundraiser which had you show some kind of donation receipt before you could get in line to get whatever food is being served. "Sorry, but you only donated $10.00, so you only get this cup of stale coffee in a styrofoam cup with creamers that date back to the Bush adminstration."

This thread is about the cost and value of year-long private schooling, not burnt coffee. Presumably the value of a year of private school education at a Mennonite school is worth more than a cup of burnt coffee.

If Mennonite churches want to engineer their entire finances to completely de-link contributions and tithes from the benefits they provide their members such as private schooling. Just so a few of their wealthiest families can claim a slightly higher tax deduction. Then fine, go for it. It is obviously a gray area of the law and you will almost certainly never be questioned about it. But if it doesn't break the letter of the law it certainly breaks the spirit of the law. Personally I don't agree with structuring church finances simply to provide tax breaks for the wealthiest members. The church my wife and I attend does nothing of the sort. They have a co-op preschool and parochial primary school and don't co-mingle finances for that reason. They are subsidized by the church and families of limited means pay only what they are able, or nothing at all. Non-members are welcome to enroll their children too. But those with means are expected to pay their way. And as far as I know, no one tries to engineer ways to deduct it from their taxes.

0 x

A fool can throw out more questions than a wise man can answer. -RZehr

-

ken_sylvania

- Posts: 4092

- Joined: Tue Nov 01, 2016 12:46 pm

- Affiliation: CM

Re: Private School Tuition and Tax Deductions

Well, first of all you misquoted and misrepresented the IRS guidance. Now you are misrepresenting the purpose and intent of the financial structure of conservative Mennonite church schools, such as are run by my church and RZehrs' church. The arrangement of the church providing oversight and financing for the school, was chosen because the founders believed the school is an important ministry of the church and that the church ought to ensure that the children of its members have ready access to good Christian schools with godly teachers. The financial arrangement was not chosen because of its tax advantaged status, as you suggest. The completely voluntary nature of funding our schools is because we want the church school to be free for our members' children to attend. It's great that the law has seen fit to allow a tax deduction for the contributions I make to our schools, but that is not why we chose this arrangement. It is an arrangement that is in compliance with the letter of the law and the spirit of the law.Ken wrote: ↑Wed Nov 22, 2023 5:02 pmI haven't made a big deal about anything. I have simply pointed out the ACTUAL IRS guidance and regulations which state that if you make a charitable donation to an organization and receive something back of substantial value, you are supposed to subtract that amount from the total deduction you claim on your taxes. Whether whether you have a donation receipt and whether it is printed on the receipt or not. And there are detailed guidelines for how to do that. You are the one who keeps coming up with far-fetched or irrelevant examples.Josh wrote: ↑Wed Nov 22, 2023 4:16 pmExcept you've made a big deal that people shouldn't be deducting the value of meals, school tuition, and presumably the value of toilet paper in the loos, "rental fees" for use of the hymnals for an hour, and on and on. So which is it? Do they need to mark down the value of their charitable contribution by the $1.65 a cup of burnt coffee was worth, or not?Ken wrote: ↑Wed Nov 22, 2023 4:01 pm

It doesn't work like that. It is the opposite of that. No one needs receipts to do anything. Certainly not to participate in a church potluck. The only purpose and point of a donation receipt is so you have a piece of paper to prove you made the donation in the event are rich and trying to itemize and deduct it from your taxes. Ordinary Christians who are not rich have no need of such things. The standard deduction goes up to $29,200 next year which means your itemized deductions have to exceed that amount for there to be any point in keeping receipts in the first place.

This thread is about the cost and value of year-long private schooling, not burnt coffee. Presumably the value of a year of private school education at a Mennonite school is worth more than a cup of burnt coffee.

If Mennonite churches want to engineer their entire finances to completely de-link contributions and tithes from the benefits they provide their members such as private schooling. Just so a few of their wealthiest families can claim a slightly higher tax deduction. Then fine, go for it. It is obviously a gray area of the law and you will almost certainly never be questioned about it. But if it doesn't break the letter of the law it certainly breaks the spirit of the law. Personally I don't agree with structuring church finances simply to provide tax breaks for the wealthiest members. The church my wife and I attend does nothing of the sort. They have a co-op preschool and parochial primary school and don't co-mingle finances for that reason. They are subsidized by the church and families of limited means pay only what they are able, or nothing at all. Non-members are welcome to enroll their children too. But those with means are expected to pay their way. And as far as I know, no one tries to engineer ways to deduct it from their taxes.

1 x

- ohio jones

- Posts: 5305

- Joined: Wed Oct 19, 2016 11:23 pm

- Location: undisclosed

- Affiliation: Rosedale Network

Re: Private School Tuition and Tax Deductions

Itemized deductions are not exclusively for the rich. I don't know where you come up with that. In fact the rich tend to be less generous and thus less likely for charitable contributions to enable them to itemize. Have you looked at the contributions made by the top people in government? Paltry. I give more than many of them, with much less income.Ken wrote: ↑Wed Nov 22, 2023 4:01 pm The only purpose and point of a donation receipt is so you have a piece of paper to prove you made the donation in the event are rich and trying to itemize and deduct it from your taxes. Ordinary Christians who are not rich have no need of such things. The standard deduction goes up to $29,200 next year which means your itemized deductions have to exceed that amount for there to be any point in keeping receipts in the first place.

Things other than contributions can also make itemization relevant. Take the case of a family with average income, but with high medical bills and a large mortgage. They might be able to itemize even without any contributions, but they certainly aren't rich, at least not after those payments.

0 x

I grew up around Indiana, You grew up around Galilee; And if I ever really do grow up, I wanna grow up to be just like You -- Rich Mullins

I am a Christian and my name is Pilgram; I'm on a journey, but I'm not alone -- NewSong, slightly edited

I am a Christian and my name is Pilgram; I'm on a journey, but I'm not alone -- NewSong, slightly edited

-

Ken

- Posts: 16239

- Joined: Thu Jun 13, 2019 12:02 am

- Location: Washington State

- Affiliation: former MCUSA

Re: Private School Tuition and Tax Deductions

I provided screenshots of the actual IRS guidance documents on this topic as well as links to the full documents so that everyone can read them and understand the context and intent.ken_sylvania wrote: ↑Wed Nov 22, 2023 5:29 pmWell, first of all you misquoted and misrepresented the IRS guidance. Now you are misrepresenting the purpose and intent of the financial structure of conservative Mennonite church schools, such as are run by my church and RZehrs' church. The arrangement of the church providing oversight and financing for the school, was chosen because the founders believed the school is an important ministry of the church and that the church ought to ensure that the children of its members have ready access to good Christian schools with godly teachers. The financial arrangement was not chosen because of its tax advantaged status, as you suggest. The completely voluntary nature of funding our schools is because we want the church school to be free for our members' children to attend. It's great that the law has seen fit to allow a tax deduction for the contributions I make to our schools, but that is not why we chose this arrangement. It is an arrangement that is in compliance with the letter of the law and the spirit of the law.Ken wrote: ↑Wed Nov 22, 2023 5:02 pmI haven't made a big deal about anything. I have simply pointed out the ACTUAL IRS guidance and regulations which state that if you make a charitable donation to an organization and receive something back of substantial value, you are supposed to subtract that amount from the total deduction you claim on your taxes. Whether whether you have a donation receipt and whether it is printed on the receipt or not. And there are detailed guidelines for how to do that. You are the one who keeps coming up with far-fetched or irrelevant examples.Josh wrote: ↑Wed Nov 22, 2023 4:16 pm

Except you've made a big deal that people shouldn't be deducting the value of meals, school tuition, and presumably the value of toilet paper in the loos, "rental fees" for use of the hymnals for an hour, and on and on. So which is it? Do they need to mark down the value of their charitable contribution by the $1.65 a cup of burnt coffee was worth, or not?

This thread is about the cost and value of year-long private schooling, not burnt coffee. Presumably the value of a year of private school education at a Mennonite school is worth more than a cup of burnt coffee.

If Mennonite churches want to engineer their entire finances to completely de-link contributions and tithes from the benefits they provide their members such as private schooling. Just so a few of their wealthiest families can claim a slightly higher tax deduction. Then fine, go for it. It is obviously a gray area of the law and you will almost certainly never be questioned about it. But if it doesn't break the letter of the law it certainly breaks the spirit of the law. Personally I don't agree with structuring church finances simply to provide tax breaks for the wealthiest members. The church my wife and I attend does nothing of the sort. They have a co-op preschool and parochial primary school and don't co-mingle finances for that reason. They are subsidized by the church and families of limited means pay only what they are able, or nothing at all. Non-members are welcome to enroll their children too. But those with means are expected to pay their way. And as far as I know, no one tries to engineer ways to deduct it from their taxes.

By contrast, neither you nor RZehr have provided a single piece of evidence that that IRS has blessed this sort of arrangement or any guidance from the IRS or any other source explaining that this sort of arrangement is sound. Not even the written opinion of a tax attorney saying these arrangements are appropriate.

Now obviously churches are free to structure their finances any way they see fit. We have freedom of religion in this country. But that isn't actually what is at question here. What is at question is whether INDIVIDUALS who donate to such a church are entitled to claim a full tax deduction for that donation when they receive very real benefits back in exchange for being a member of that same church. And whether it is appropriate for the church to provide a receipt back to that member stating that thousands of dollars of contributions were made and nothing of value was received in return.

0 x

A fool can throw out more questions than a wise man can answer. -RZehr

-

Ken

- Posts: 16239

- Joined: Thu Jun 13, 2019 12:02 am

- Location: Washington State

- Affiliation: former MCUSA

Re: Private School Tuition and Tax Deductions

OK, let's look at a family of average income. The median household income in the US in 2023 was $74,580 so let's use that figure for someone of average income.ohio jones wrote: ↑Wed Nov 22, 2023 5:45 pmItemized deductions are not exclusively for the rich. I don't know where you come up with that. In fact the rich tend to be less generous and thus less likely for charitable contributions to enable them to itemize. Have you looked at the contributions made by the top people in government? Paltry. I give more than many of them, with much less income.Ken wrote: ↑Wed Nov 22, 2023 4:01 pm The only purpose and point of a donation receipt is so you have a piece of paper to prove you made the donation in the event are rich and trying to itemize and deduct it from your taxes. Ordinary Christians who are not rich have no need of such things. The standard deduction goes up to $29,200 next year which means your itemized deductions have to exceed that amount for there to be any point in keeping receipts in the first place.

Things other than contributions can also make itemization relevant. Take the case of a family with average income, but with high medical bills and a large mortgage. They might be able to itemize even without any contributions, but they certainly aren't rich, at least not after those payments.

First of all, medical expenses are only deductible if they exceed 7.5% of AGI and then only the amount that exceeds AGI. So for our family the 7.5% threshold would be $5,593.50. Today the average family deductible for an ACA silver plan is about $4,500 so anyone who has a median insurance plan should not have medical expenses that reach the 7.5% limit. That is actually very rare. But even if they had huge unreimbursed expenses of say $10,000 that only provides them with a deduction of $4,407. So we are still $24,700 short of exceeding the standard deduction.

The rule of thumb used for determining mortgage affordability is 28/36 meaning that you can afford a mortgage equal to 28% of your gross monthly income or 36% of your net monthly income. In the case of our median family, their gross monthly income would be $6,215 and they could afford a maximum monthly mortgage payment of $1,740. How much interest is contained within that maximum mortgage payment depends on where they are at in their mortgage, the interest rate, how much is PMI and escrow payment for homeowners insurance and so forth. But if we generously say that half their mortgage is deductible interest (and most aren't) and that they have the maximum mortgage they can afford that would produce deductible interest payments of about $10,000 per year. So now we are $14,700 short of exceeding their standard deduction.

If this median family is tithing to their church at the standard 10% rate that would be another $7,458 and we are still $7,335 short of reaching the standard deduction. They would actually have to be tithing at a 20% rate to even reach the standard deduction and would need to be exceeding a 20% tithe rate to even consider bothering to itemize. I don't know how many families with school-age children are tithing at a rate higher than 20% but I suspect it isn't terribly common.

I would suggest that a family with children really needs a household income well into six figures in order to reasonably have enough deductible expenses to exceed the 2024 standard deduction of $29,200. Which in my book puts them squarely into the category of wealthy. Perhaps you have different standards. Can we generate a hypothetical family at the median household income who reaches it? Perhaps, but we have to really stretch to reach it and make edge assumptions about medical expenses, mortgage costs, and tithing to even get close. I would suggest that the vast majority of families at the median household income come nowhere close. So I stand by my contention that this is largely an accommodation for the wealthy. In 2022 approximately 90% of Americans took the standard deduction and only about 10% itemized their deductions. So I would suggest it is largely the terrain of the top 10% which I would define as the wealthy. The top 10% STARTS with a household income of $191,400 in this country. I would suggest that is wealthy.

0 x

A fool can throw out more questions than a wise man can answer. -RZehr

-

ken_sylvania

- Posts: 4092

- Joined: Tue Nov 01, 2016 12:46 pm

- Affiliation: CM

Re: Private School Tuition and Tax Deductions

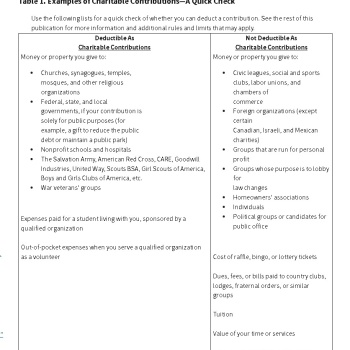

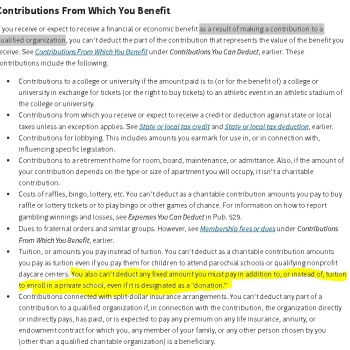

Yes, you certainly did. And I noticed that the IRS guidance documents say about the topic is different from what you claimed they say. The IRS guidance documents are very clear that if a benefit is provided in exchange for a contribution, then that portion of the contribution is not tax deductible. That's not what you've been saying though. You've been claiming that the test is whether a benefit is received from the same charitable organization to which a contribution is made. The IRS guidance documents and all the other stuff you posted say nothing at all that would support your claim.

And the answer to the question is - INDIVIDUALS who donate are entitled to claim a full tax deduction for that donation even if they receive tangible benefits by virtue of being a member of that same church, unless the benefit is received in exchange for the contribution. It's actually quite simple. And you have not provided one iota of evidence that would so much as suggest anything different.Ken wrote: ↑Wed Nov 22, 2023 5:49 pm By contrast, neither you nor RZehr have provided a single piece of evidence that that IRS has blessed this sort of arrangement or any guidance from the IRS or any other source explaining that this sort of arrangement is sound. Not even the written opinion of a tax attorney saying these arrangements are appropriate.

Now obviously churches are free to structure their finances any way they see fit. We have freedom of religion in this country. But that isn't actually what is at question here. What is at question is whether INDIVIDUALS who donate to such a church are entitled to claim a full tax deduction for that donation when they receive very real benefits back in exchange for being a member of that same church. And whether it is appropriate for the church to provide a receipt back to that member stating that thousands of dollars of contributions were made and nothing of value was received in return.

0 x

Re: Private School Tuition and Tax Deductions

Okay. I’ve just sent the question to two different tax accounts in different companies. And two attorneys. I guess we will see what they say. None of these four are Mennonite, one used to be.Ken wrote: ↑Wed Nov 22, 2023 5:49 pmI provided screenshots of the actual IRS guidance documents on this topic as well as links to the full documents so that everyone can read them and understand the context and intent.ken_sylvania wrote: ↑Wed Nov 22, 2023 5:29 pmWell, first of all you misquoted and misrepresented the IRS guidance. Now you are misrepresenting the purpose and intent of the financial structure of conservative Mennonite church schools, such as are run by my church and RZehrs' church. The arrangement of the church providing oversight and financing for the school, was chosen because the founders believed the school is an important ministry of the church and that the church ought to ensure that the children of its members have ready access to good Christian schools with godly teachers. The financial arrangement was not chosen because of its tax advantaged status, as you suggest. The completely voluntary nature of funding our schools is because we want the church school to be free for our members' children to attend. It's great that the law has seen fit to allow a tax deduction for the contributions I make to our schools, but that is not why we chose this arrangement. It is an arrangement that is in compliance with the letter of the law and the spirit of the law.Ken wrote: ↑Wed Nov 22, 2023 5:02 pm

I haven't made a big deal about anything. I have simply pointed out the ACTUAL IRS guidance and regulations which state that if you make a charitable donation to an organization and receive something back of substantial value, you are supposed to subtract that amount from the total deduction you claim on your taxes. Whether whether you have a donation receipt and whether it is printed on the receipt or not. And there are detailed guidelines for how to do that. You are the one who keeps coming up with far-fetched or irrelevant examples.

This thread is about the cost and value of year-long private schooling, not burnt coffee. Presumably the value of a year of private school education at a Mennonite school is worth more than a cup of burnt coffee.

If Mennonite churches want to engineer their entire finances to completely de-link contributions and tithes from the benefits they provide their members such as private schooling. Just so a few of their wealthiest families can claim a slightly higher tax deduction. Then fine, go for it. It is obviously a gray area of the law and you will almost certainly never be questioned about it. But if it doesn't break the letter of the law it certainly breaks the spirit of the law. Personally I don't agree with structuring church finances simply to provide tax breaks for the wealthiest members. The church my wife and I attend does nothing of the sort. They have a co-op preschool and parochial primary school and don't co-mingle finances for that reason. They are subsidized by the church and families of limited means pay only what they are able, or nothing at all. Non-members are welcome to enroll their children too. But those with means are expected to pay their way. And as far as I know, no one tries to engineer ways to deduct it from their taxes.

By contrast, neither you nor RZehr have provided a single piece of evidence that that IRS has blessed this sort of arrangement or any guidance from the IRS or any other source explaining that this sort of arrangement is sound. Not even the written opinion of a tax attorney saying these arrangements are appropriate.

Now obviously churches are free to structure their finances any way they see fit. We have freedom of religion in this country. But that isn't actually what is at question here. What is at question is whether INDIVIDUALS who donate to such a church are entitled to claim a full tax deduction for that donation when they receive very real benefits back in exchange for being a member of that same church. And whether it is appropriate for the church to provide a receipt back to that member stating that thousands of dollars of contributions were made and nothing of value was received in return.

0 x

-

ken_sylvania

- Posts: 4092

- Joined: Tue Nov 01, 2016 12:46 pm

- Affiliation: CM

Re: Private School Tuition and Tax Deductions

OK, here you go. This is from the IRS website explaining why contributions to a church are tax deductible when no tangible benefit is received in exchange.Ken wrote: ↑Wed Nov 22, 2023 5:49 pm By contrast, neither you nor RZehr have provided a single piece of evidence that that IRS has blessed this sort of arrangement or any guidance from the IRS or any other source explaining that this sort of arrangement is sound. Not even the written opinion of a tax attorney saying these arrangements are appropriate.

And this one explains why it would be impermissible to deduct any purported donation if that donation was mandatory in order for one's child to attend a parochial school:

0 x